ExpatInvest helps you grow your RMB

Invest your extra CN¥ income in China and grow from there.

Investing within China, made easy

- Invest your local Chinese Yuan Renminbi savings in reputable mutual funds.

- No currency exchanges, buy & sell in CN¥ RMB.

- No trips to the bank, buy & sell online.

- No lock-in periods, buy & sell when you want.

- English language data, service, & support.

- Invest your local Chinese Yuan Renminbi savings in reputable mutual funds.

- No currency exchanges, buy & sell in CN¥ RMB.

- Online orders, buy & sell on your schedule.

- English language data, service, & support.

- No complicated fees or lock-in periods.

13.23%

is the average annual return of all ExpatInvest funds over the last 5 years.*

0.74%

is the average annual return of the benchmark CSI 300 Index in the same time period.

0.3%

is the average annual interest rate at major Chinese banks in the same time period.**

Let us help you be more productive with your RMB.

**0.3% is a general average for savings accounts in mainland China.

A simple process to buy and sell funds in China

Register in about 8 minutes.

Submit buy/sell orders on this site, or directly via Wechat with our English-speaking team.

Start from ¥1,000 RMB.

Transact securely with Alipay or your Chinese bank.

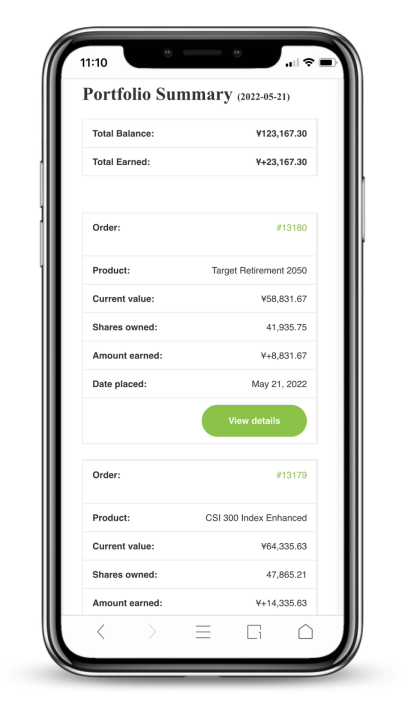

Not ready for the real thing yet? Try out a free simulated portfolio.

Our Funds

Our current products are mutual funds issued for trading in Mainland China, carefully curated based on several criteria, including:

- Solid mid to long term performance history,

- Transparent underlying assets,

- Large, national-level Chinese banks acting as custodians.

Scroll to view more info >>

| Fund Name | Fund Type | Risk Profile | Annual Average, 2020-2024 | 2024 | 2023 | 2022 | 2021 | 2020 | More Info | Buy Now |

|---|---|---|---|---|---|---|---|---|---|---|

| Managed Debt Mix | Domestic – Bond Fund | 01 | 3.76% | 2.33% | -1.88% | 0.95% | 6.91% | 10.48% | Fund details | |

| Conservative Bond & Stock Blend | Domestic – Hybrid Fund (20% stock / 80% debt) | 02 | 8.20% | 6.71% | 3.08% | 3.93% | 16.30% | 10.98% | Fund details | |

| Gold ETF | Domestic – Commodity Fund (90% commodity holdings) | 03 | 14.82% | 25.52% | 15.55% | 8.70% | -5.11% | 13.51% | Fund details | |

| New Income Stock & Bond Mix | Domestic – Hybrid Fund (80% stock / 20% debt) | 03 | 12.78% | -0.55% | -11.30% | -19.81% | 12.74% | 82.83% | Fund details | |

| CSI 300 Index Enhanced | Domestic – Stock Index Fund | 04 | 6.06% | 14.55% | -11.89% | -17.32% | 3.80% | 41.17% | Fund details | |

| Beijing Stock Exchange 50 Index | Domestic – Stock Index Fund | 07 | 10.18% | 6.39% | 13.98% | Fund Details | ||||

| China Information Technology Industry | Domestic – Sector Stock Fund | 08 | 20.95% | 0.29% | -4.01% | -29.51% | 43.34% | 94.64% | Fund details | |

| China Modern Manufacturing Industry | Domestic – Sector Stock Fund | 09 | 16.82% | -15.46% | -21.55% | -32.37% | 22.93% | 130.56% | Fund details | |

| China AI ETF | Domestic – Sector Stock Fund | 10 | 16.02% | 20.50% | 11.54% | Fund details | ||||

| CSI 300 benchmark comparison (?) | Domestic – Shanghai & Shenzhen Stock Market Index | 0.74% | 14.68% | -11.38% | -21.63% | -5.20% | 27.21% |

Scroll to view more info >>

Don’t see the type of fund you’re looking for here? Let us know!

When selecting products, please remember: Investing involves risk. Our team is here to help with any questions you may have about investment goals and risks.

Don’t see the type of fund you’re looking for here? Let us know!

When selecting products, please remember: Investing involves risk. Our team is here to help with any questions you may have about investment goals and risks.

Invest with Confidence

- Secure payment processing.

- Bank-grade security on holdings (see custodians below).

- Funds are issued by major investment companies, publicly audited, and trade publicly on Chinese exchanges.

- The ExpatInvest team invests with you - we are active in these funds and the China markets.

- ExpatInvest is a legally registered partnership in China.

Fund Custodians:

ExpatInvest Partners:

We work in partnership with Citic Bank and Citic Securities. This partnership:

1) Enables us to stay compliant and secure, and

2) Gives us access to full brokerage privileges as a qualified investor in the Chinese markets.

Category 1: Domestic Stock Funds

These funds are 100% invested in domestic Chinese stocks that are publicly listed on the Shanghai and Shenzhen exchanges.

Modern manufacturing, machinery, automotive, and mining.

Invest in China's rapidly expanding healthcare sector

New to the Chinese markets?

Try out a free simulated portfolio

- We'll set you up with a test account to explore.

- Build out a portfolio of our funds yourself or browse the pre-made one.

- Track balances in your simulated account in real time, updated every trading day.

Frequent Questions

Yes. One of the advantages of using ExpatInvest is that there is no foreign currency involved at all. All transactions take place in RMB, and all underlying assets are denominated in RMB. When you sell investments, amounts will be returned to your Chinese bank account or Alipay in RMB.

Currently, all of our funds have a minimum purchase amount of ¥1,000 RMB.

Yes you can invest the salary you earn and the savings you have in China, as long as that income has been properly taxed.

You can sell your investments as soon as you’d like after purchasing them. Fund companies may assess a small fee if you sell within the first month of ownership. After one month there are no fees or penalties for selling.

Yes – two of our current funds offered invest in international companies. The NASDAQ 100 RMB Index Fund holds the top 100 US-listed companies on the Nasdaq exchange. The S&P 500 RMB Index Fund holds the companies in the Standard & Poor’s 500 Index. We are open to offering more of these types of funds based on demand.

Yes! We have a guide on how to set up automatic payments via Alipay. Contributing regularly to your investment portfolio is called Dollar Cost Averaging, and is widely regarded as a sound investment strategy.

Our WeChat official account ID is ‘ExpatInvest’ (QR code below). From the WeChat account, you can perform all account tasks such as checking your account details & balance, placing buy & sell orders, etc.

We do not have a mobile app at this time.

Recent Resources

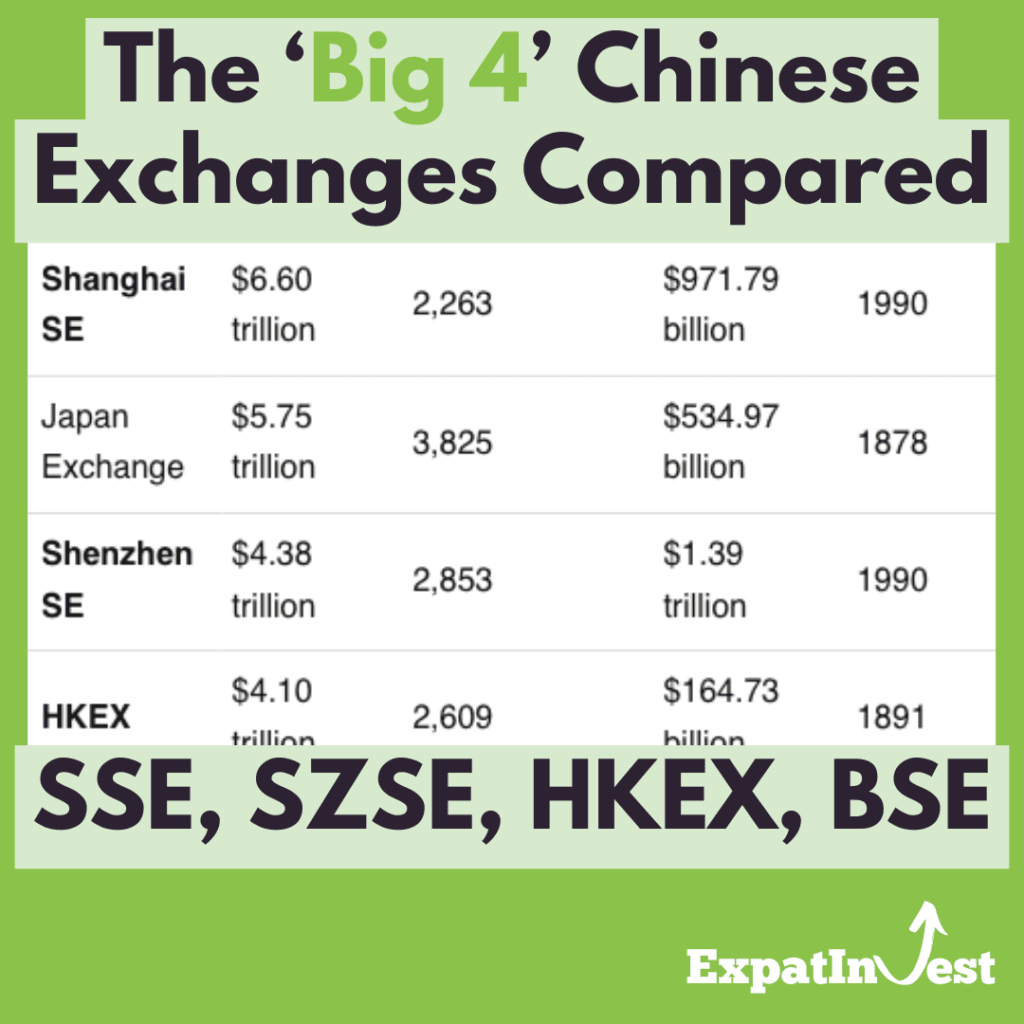

Chinese Stock Exchanges Compared: Shanghai / Shenzhen / Beijing / HK

China Finance and Economy News – 2024 best sources

China Expat Investors: Navigating a Down Market

Compound Interest for Expats in China

The Chinese Stock Markets: Terms & Acronyms Guide

Not ready to invest yet, but want to keep up with China markets? Leave your email, and we’ll send you our new blog posts & China finance content.