Conservative Bond & Stock Blend

Product Summary

Quick Look:

A Hybrid fund invests in a combination of both stocks and bonds, while still trying to maximize growth. This fund has a conservative approach that invests in an average of 20% stocks and 80% debt since opening in 2016.

The fund is actively managed, so the actual makeup of the fund at any time may slightly deviate as the fund management team seeks to minimize risk while maximizing returns in current market conditions.

From the Fund Manager:

Stock selection: The fund explores high-quality listed companies through a combination of analyzing the growth prospects, industry structure, and business models of the industry as a whole. Investment opportunities are selected through analysis of competitive factors such as bottom-up evaluation of the company’s products, core competitiveness, management, and governance structure.

Debt selection: The fund focuses on duration control and structural distribution strategies through in-depth analysis of macroeconomic data, monetary policy, and interest rate trends, as well as different types of yield levels, liquidity, and credit risks. Curve strategy & spread strategy are supplemented to construct a combination of bonds and money market instruments that can provide stable returns.

View full prospectus (in Chinese)

Fund Facts

** Expense ratio amounts are already included in the return and daily value figures listed. More info on fees.

Performance

Scroll to view more info >>

| Time Period | Return, Conservative Bond & Stock Blend | Performance Rank in Category (?) | Return, CSI 300 Index benchmark (?) |

|---|---|---|---|

| 2024 | 6.71% | Top 35% | 14.68% |

| 2023 | 3.08% | Top 10% | -11.38% |

| 2022 | 3.93% | Top 20% | -21.63% |

| 2021 | 16.30% | Top 2% | -5.20% |

| 2020 | 10.98% | Bottom 50% | 27.21% |

| 2019 | 12.77% | Bottom 50% | 36.07% |

| 2018 | 6.10% | Top 2% | -25.31% |

| 2017 | 6.75% | Top 50% | 21.78% |

| Annual Average | 8.15% | 4.53% | |

| Open Date | 2016/12/22 |

Returns Comparison

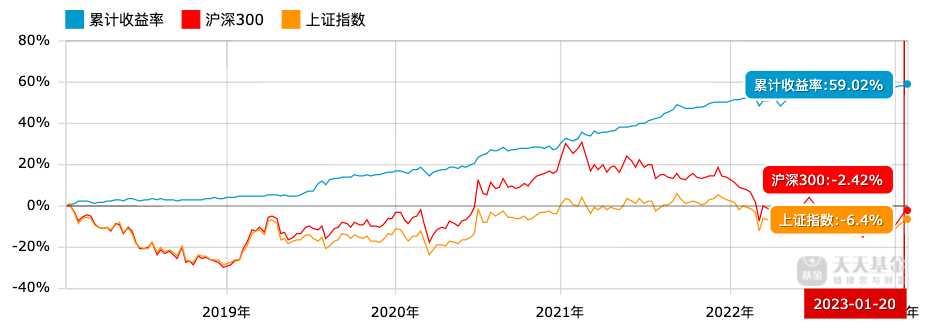

This chart illustrates the fund performance in comparison to the general Chinese markets over the 5 years spanning 2018/1/20-2023/1/20.

The Conservative Bond & Stock Blend fund is in blue, the CSI 300 Index in red, and the Shanghai & Shenzhen Composite in orange.

Over this timeframe, the The Conservative Bond & Stock Blend fund outperformed the CSI 300 Index by 61.44% and the Shanghai & Shenzhen Composite by 65.42%.

Top 10 Holdings

Hypothetical Portfolio Growth

Returns Comparison

This chart illustrates the fund performance in comparison to the general Chinese markets over the 5 years spanning 2018/1/20-2023/1/20. The Conservative Bond & Stock Blend fund is in blue, the CSI 300 Index in red, and the Shanghai & Shenzhen Composite in orange.

Over this timeframe, the The Conservative Bond & Stock Blend fund outperformed the CSI 300 Index by 61.44% and the Shanghai & Shenzhen Composite by 65.42%.