Beijing Stock Exchange 50 Index Fund

Product Summary

Quick Look:

Invest in the Beijing Stock Exchange 50 Index, also known as the BSE 50. The Beijing Stock Exchange launched in September 2021 as a way to improve financing for China’s small and medium-sized enterprises (SMEs), specifically those considered innovation-based by the exchange. The index tracks the stock performance of 50 of the largest companies listed on the BSE. For more information on the BSE 50 Index: ExpatInvest, Wikipedia.

From the Fund Manager:

This fund adopts a passive index investment strategy to effectively track the BSE 50 component index, and strives to minimize the tracking deviation and tracking error of the underlying index.

View full prospectus (in Chinese)

Fund Facts

** Expense ratio amounts are already included in the return and daily value figures listed. More info on fees.

Recent Performance

Scroll to view more info >>

Returns Comparison

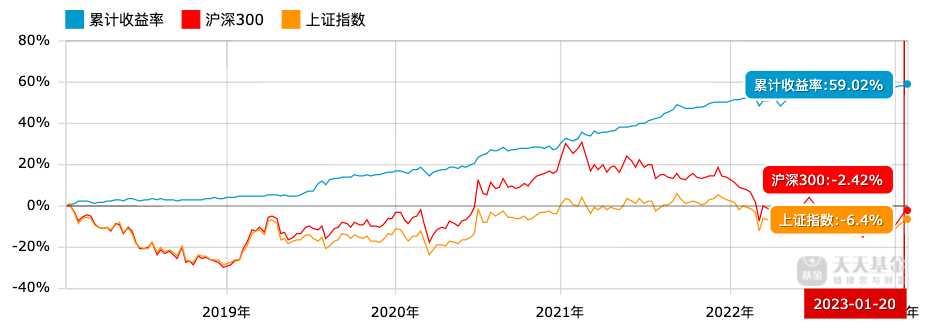

This chart illustrates the fund performance in comparison to the general Chinese markets over the last 5 years (2018/1/20-2023/1/20).

The Conservative Bond & Stock Blend fund is in blue, the CSI 300 Index in red, and the Shanghai & Shenzhen Composite in orange.

Over this timeframe, the The Conservative Bond & Stock Blend fund outperformed the CSI 300 Index by 61.44% and the Shanghai & Shenzhen Composite by 65.42%.

Top 10 Holdings

Hypothetical Portfolio Growth

Returns Comparison

This chart illustrates the fund performance in comparison to the general Chinese markets over the last 5 years (2018/1/20-2023/1/20). The Conservative Bond & Stock Blend fund is in blue, the CSI 300 Index in red, and the Shanghai & Shenzhen Composite in orange.

Over this timeframe, the The Conservative Bond & Stock Blend fund outperformed the CSI 300 Index by 61.44% and the Shanghai & Shenzhen Composite by 65.42%.