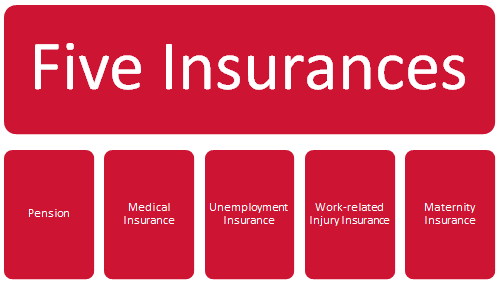

Do you live in Shanghai? Are you paying contributions to the social insurance scheme as an expatriate employee in China? Read on to learn about your options and responsibilities.

In 2009, Shanghai tax authorities published a policy indicated that expats ‘may’ contribute to social insurance but were not required to do so. Companies may, at their own initiative or at the request of their employees, voluntarily contribute. This remains unchanged to today in practice.

In 2011, the national tax authorities passed a law requiring all employers and employees to contribute to social insurance, including foreigners. Shanghai has not enforced this. The 2009 Shanghai circular (‘may’ contribute) was extended in 2016, and left to expire on August 15th 2021, leading to much uncertainty about the requirements around social insurance contributions for foreigners.

By law, contributions should have been made since then. Up until the date this publication, the Shanghai social security bureau has not taken steps to enforce collection unless a specific request or complaint was made. From speaking to tax professionals, they indicate that no new instructions to review social insurance by foreigners have been received.

Employers and tax professionals expect the current taxation process to be followed until there is a new policy. As of the time of writing, there are companies in the city with expatriate employees who are not contributing to the social insurance scheme and remain compliant with the tax authorities requirements.

Each case can be different. We recommend you check with your HR or a tax service provider to clarify your own social insurance responsibilities. It is worth investigating, as the contributions can increase the tax burden for both you and your employer.

To estimate the impact, check out some of the Income Tax calculators available online:

For more information: