The Shanghai STAR Market (SSE STAR) is a modern stock market that is often compared to NASDAQ in the US. It is a market that is a component of the larger Shanghai Stock Exchange (SSE), and primarily holds Science and Technology companies.

Founded in 2018, the Shanghai STAR Market started off as a way for China’s tech companies to gain easier and greater access to public capital. The market has become home to some of China’s biggest technology and start-up successes.

In this article, we delve into the history, trading volumes, statistics, and the diverse array of companies listed on the Shenzhen Stock Exchange.

The Name

The full name of the Shanghai STAR Market is the ‘Science and Technology Innovation Board‘. STAR is taken from one letter of each word of Sci-Tech innovAtion boaRd. [source]

History

Timeline

Here’s a breakdown of major events in the history of the Shanghai STAR Market:

1891

The ‘Shanghai Share Brokers Association’, an early form of a stock exchange, was established in Shanghai. Over about 100 years, The Shanghai Stock Exchange is formed, closed twice, and reopened in the modern era. Check out our full timeline on the SSE.

1990

After being closed for 41 years (since 1949), the modern Shanghai Stock Exchange was re-established.

2018

On November 5th 2018, China’s president announced a new science and technology board be added to the Shanghai Stock Exchange:

"[China will] launch a science and technology innovation board ('SSE STAR Market') and the pilot registration-based IPO system at the Shanghai Stock Exchange, support Shanghai's bid to become an international financial center and science and innovation hub, and steadily improve the foundations of the domestic capital market."

The original announcement goes on to explain how the SSE STAR Market is committed to supporting sci-tech and innovative enterprises that align with national strategies, hold core and breakthrough technologies, and enjoy a high degree of market recognition.

2019

On July 22, 2019, the first group of 25 companies became listed for public trading.

2022

As of the end 2022, 501 companies were listed on the SSE STAR Market with a market cap of over 6 trillion Chinese Yuan (~$828 billion USD).

The Modern SSE STAR Market, By the Numbers

Top Line Stats

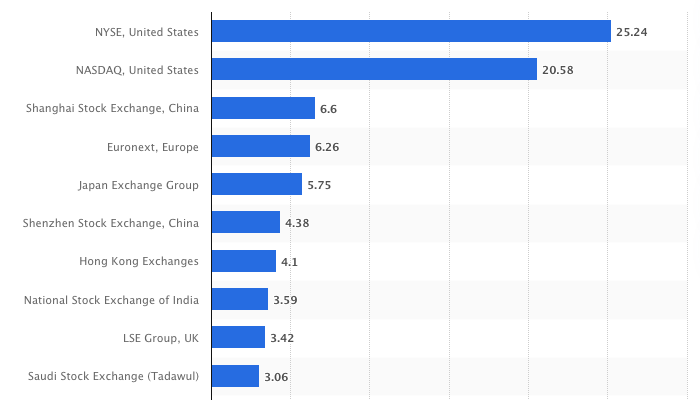

By mid 2023, the STAR market had nearly 550 companies listed with ¥6.4 Chinese Yuan trillion in market cap. The young market, often referred to as the ‘NASDAQ of China‘ is large on its own indeed, ranking among the world’s top stock markets by capitalization. [2023 figures]

As of December 2023, the market capitalization of the STAR Market’s parent exchange, the Shanghai Stock Exchange, stands at $6.6 trillion USD. This makes it the world’s 3rd largest stock exchange.

The Shanghai STAR market makes up $911 billion USD of this capitalization, or about 13.8% of the entire Shanghai exchange. For context, this is about the size of Brazil’s national market, the Brasil Bolsa Balcão.

Another point on this impressive growth – the SSE STAR Market was actually home to the most IPOs globally in 2022!

It’s important to emphasize that the Shanghai STAR Market has grown to be the 20th largest exchange by market cap in only about 4 years!

To put that into perspective, here are the starting years of some of the other leading stock exchanges:

- Amsterdam Stock Exchange (now Euronext Amsterdam) – 1602

- Paris Stock Exchange (now Euronext Paris) – 1724

- New York Stock Exchange – 1792

- London Stock Exchange – 1801

- Bombay Stock Exchange – 1875

So the STAR market has been growing fast, adding companies rapidly, and providing a much needed capital boost for companies hoping to succeed through China’s post-COVID economic recovery.

Check out our entry on the Shenzhen Stock Exchange

Performance

The most common way to track SSE STAR Market is via SSE STAR 50 Index. This index tracks the top 50 stocks on the STAR market (ranked by market cap).

After starting at a price 1,000 in late 2019, the STAR market has had an up and down turn that matches the Shanghai Stock Exchange and Chinese markets in general over the period.

Industries Represented

Technology and Innovation: The STAR exchange is renowned for its support of the science and technology sector in China. After all, it was primarily created to focus on listing (and getting funding for) tech companies on the SSE. These companies operate in cutting-edge fields such as artificial intelligence, biotechnology, e-commerce, and telecommunications, driving innovation and contributing to China’s technological advancement.

Here’s a more specific sector breakdown as of April 2024. ‘New Generation IT’ makes up a whopping 35% of the companies listed. ‘High End Equipment’ and ‘Biomedicine’ firms follow with 21.4% and 19.4%, respectively.

Wrap Up

We hope you’ve learned a thing or about China’s new and fast-growing exchange, the Shanghai STAR Market! The exchange is (relatively) new, and the topic big – so count on updates to this article as an ongoing project.

I’d also like to mention we have covered some of China’s other big exchanges and indexes in a similar fashion:

The Shanghai Stock Exchange: An Introduction

Our Guide to The Shenzhen Stock Exchange (SZSE)

The Beijing Stock Exchange: An Introduction

An Introduction to the CSI 300: China’s S&P 500

Ganbei!

Share this article: