Kweichow Moutai: China’s Largest Alcohol and Spirit Producer

Kweichow Moutai specializes in the production and sales of Moutai or Maotai, a high-end distilled Chinese liquor better known as Baijiu. Based out of Guizhou province, the company is renowned for its unique production methods and exceptional product quality in the category. While the majority of its sales occur in the Chinese markets (approximately 95%), Kweichow Moutai is working to become a leading player in the luxury alcoholic beverage industry globally.

Like many major corporations in China, Kweichow Moutai is partially state-owned. The company has experienced significant growth over the past decade+ and is now ranked as the largest brand in the Chinese spirits sector. It has simultaneously grown to become an important symbol of Chinese culture and tradition.

Check out our entry on LONGi – the world’s largest solar manufacturer.

Company History

While Kweichow Moutai was officially incorporated in 1999, its history can be traced back to the Qing Dynasty (1644-1912). This was when the first Moutai liquor was produced during the 18th century. Over the years, the company has achieved various milestones, solidifying its position as a leading Chinese brand.

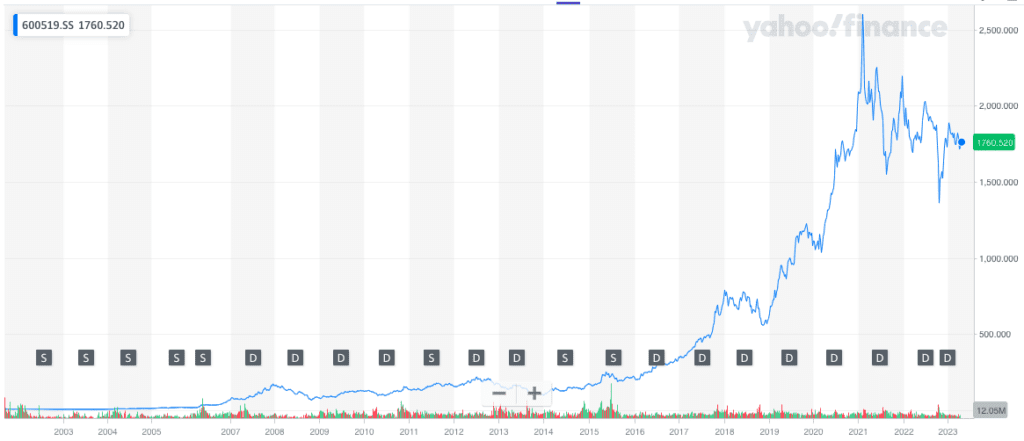

In 2001, Kweichow Moutai was listed on the Shanghai Stock Exchange. This action further expanded its presence in the Chinese markets and beyond. This gave the company global recognition and positioned it for additional growth in subsequent years.

A few years later, in 2004, Kweichow Moutai created a strategic partnership with Camus Cognac to exclusively sell Kweichow Moutai products in the duty-free market at airports and other duty-free retail outlets across the globe.

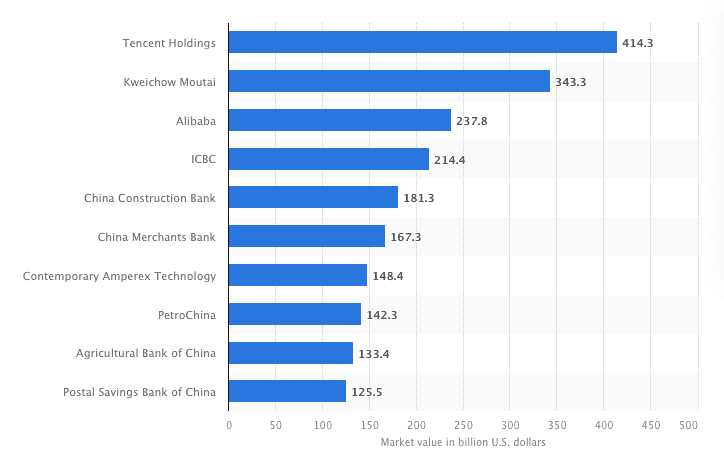

By 2021 Kweichow Moutai achieved the status of largest beverage company in the world and most valuable company in China outside of the technology sector (namely Tencent).

Check out our profile on another top 10 company: Solar giant Contemporary Amperex Technology (CATL)

Key Products and Brands

Kweichow Moutai is known for its wide range of high-quality products and brands. Their most popular and recognized products are primarily within the Moutai liquor line, known for its unique flavor, aroma, and production process. Its flagship product, Moutai Feitian (translated to Flying Fairy), is considered a luxury item and often given as a gift or consumed during special occasions like Chinese New Year, weddings, and birthday celebrations. Other common products include Moutai Prince, Moutai Yingbin Chiew, Moutai Gold, and Moutai Legend.

In addition to the Moutai brand, Kweichow Moutai is the parent company for brands such as Guojiao 1573, Xi Jiu, and Lang Jiu. This positions Kweichow Moutai to provide a variety of tastes for its diverse consumer base.

Financial Snapshot

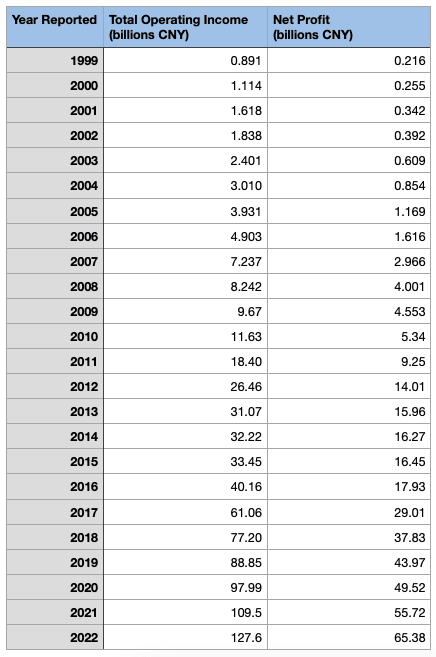

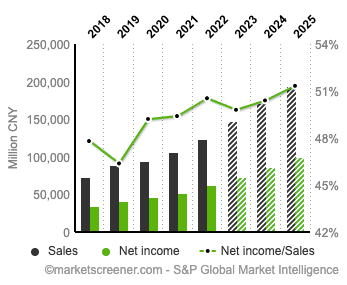

Listed on the Shanghai Stock Exchange, Kweichow Moutai’s market capitalization has grown significantly since its initial public offering (IPO). In 2022 alone, the company generated about ¥124 billion (approximately $17.9 billion USD) in revenue with ¥62 billion in net profit (approximately $8.9 billion USD), a 19% increase over 2021.

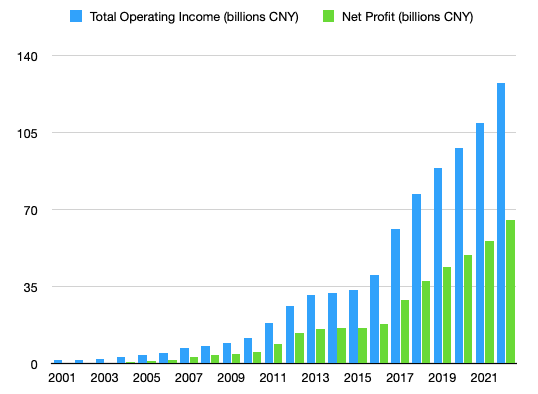

If we go back to company beginnings, we can see that revenue and profits have been growing steadily for over 20 years. In fact, the company has grown every year since opening up shop:

The stock price has generally grown along with revenue, from around 7 RMB per share in 2001 to over 1,700 RMB per share as of writing this in 2023/5. The equity has provided a fantastic return for most long term investors involved.

Current data from MarketScreener has Kweichow Maotai continuing to grow through the 2020’s – reaching nearly 200 billion in revenue by 2025. It’s important to note that this is a technical prediction based on current data the company has publicly provided.

Wrap Up

As the company continues to expand its product offerings and global presence, it remains a compelling investment opportunity for those looking to invest in a well-established Chinese company. Kweichow Moutai has long-term potential for strong growth based on its ever expanding brand, a loyal Chinese consumer base, and historical performance.

Would you like to add this stock to your portfolio? Kweichow Moutai is a core component of ExpatInvest’s CSI 300 Enhanced Fund.

Share this article: