For most expatriates who have a single source of income from their employer, tax filing is often not required. Your HR will prepay all of the required income taxes, and if you have no other sources of income and spend most of the year in China, then your pre-paid taxes will match exactly the tax owed, and thus a filing is not required. Simple, right? If you need to file your taxes separately, there are some great guides like this one from HROne.

Whether you file your own tax returns or not, you should have income tax records in China if you’re on a work visa.

Why do I need to get my tax records?

Whether you file taxes or not, you will have tax records if you are paying income taxes. Obtaining and holding on to your tax records is always a good practice. You may need tax records to:

- Prove tax residency in your home country

- Apply for a new job

- Apply for a credit card

- Wire larger amounts of money outside of China

How can I get my tax records?

To get your tax records you can:

- Ask your HR for help. They can point you in the direction of the closest tax office, and in many cases may be able to print the tax records on your behalf.

- Get the documents printed yourself. Your HR can point you to the closest tax office. There is also a hotline for tax services available in some areas. Simply dial 12366. If you’re in Shanghai, there is even an English service available by pressing “2” in the menu. You can also search in Alipay: the home page (or under “More”) is “City Service.” Tap this, and scroll sideways until you find “税务.” From here you can find a map “地图” with addresses and telephone numbers for the closest tax authorities. It’s best to call ahead and make sure this is the correct office for obtaining your records.

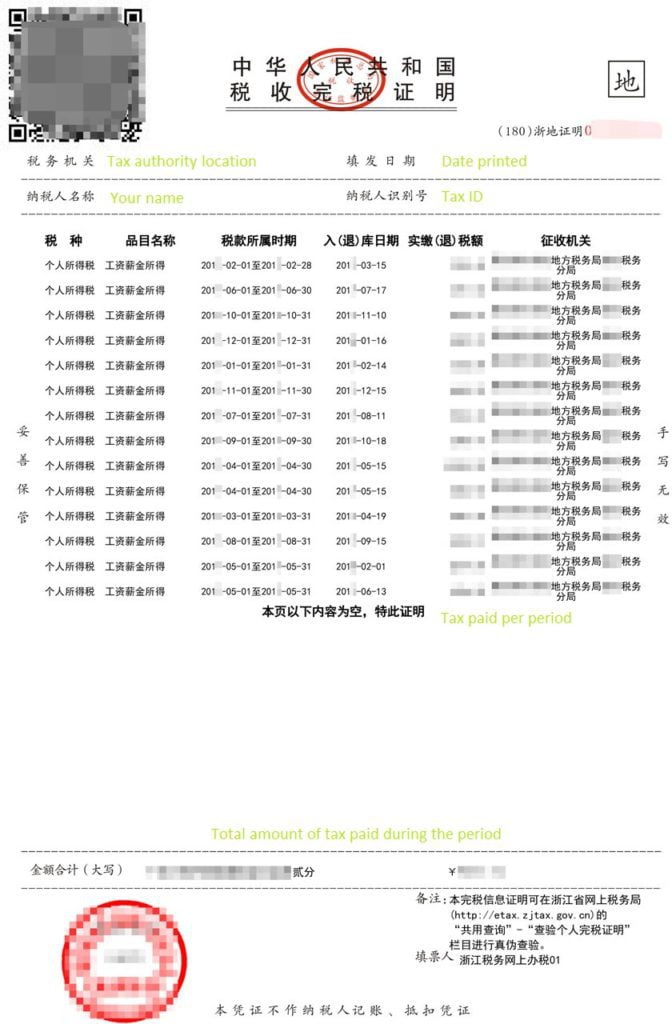

The actual application process is quite simple. Bring your passports (including previous passports if you want to obtain the tax information associated with that passport number) and head over to the tax office. When you arrive at the tax authority office, tell them you want to print out your income tax history (税收完税证明) or show them the picture below. It is also recommended to get the Personal Income Tax List (国家税务总局上海市税务局个人所得谁纳税清单 which shows more comprehensive information. The officers will print out the tax records for any time period you choose, and can print out multiple copies.

That’s it! Hold on to those documents, and make sure you obtain new copies at least once per year.