The Shenzhen Stock Exchange (SZSE) stands as a symbol of China’s economic growth and global financial influence. Founded in 1990, the marketplace has evolved into one of the world’s largest stock exchanges, offering a gateway to investment opportunities in the heart of China’s dynamic economy. In this article, we delve into the history, trading volumes, statistics, and the diverse array of companies listed on the Shenzhen Stock Exchange.

History

The Lead Up: Financial Reforms in China

The roots of the Shenzhen Stock Exchange trace back to the early days of China’s economic reforms in the late 1970s and early 1980s. As part of the nation’s ambitious push towards market-oriented reforms, the Chinese government initiated the establishment of stock exchanges to facilitate the mobilization of capital and spur economic growth.

Formally opening on December 1, 1990, the Shenzhen Stock Exchange started with a modest beginning, primarily serving as a platform for trading shares of state-owned enterprises (SOEs) and collectively-owned enterprises (COEs). Over the years, the exchange underwent significant transformations, witnessing exponential growth in trading volumes, market capitalization, and the number of listed companies.

Timeline

Here’s a breakdown of major events in the history of the Shenzhen Stock Exchange:

1990

December 1st: the SZSE started operation.

1991

March: The computerized trading system developed by SZSE was put into operation.

April: SZSE launches its first stock index, the SZSE Composite Index, using April 3rd, 1991 as the first day with a base value of 100 points.

November: Yantian Port Key Construction issues the first bond listed on SZSE.

1992

February: SZSE launches a computer-automated order-matching and bidding system, making the shift from manual bidding to automatic matching. China Southern Glass Co., Ltd. issues the first B-shares on the SZSE.

1993

January: A new trading floor increases the number of trading seats from 32 to 210 and the daily trade matching capacity from 20,000 deals per day to 60,000 deals per day.

September: China Bao’an Group Co., Ltd. announced that they held more than 5% of the outstanding ordinary shares of SSE-listed Yanzhong Industrial. This sets a precedent for Chinese enterprises to conduct M&A activities through the domestic securities markets.

December: The SZSE reaches 77 listed companies located in 17 provinces throughout China.

1994

March: The inception of Shenzhen Treasury-bond cash market. A full T-bond futures business launches later in the year.

1995

July: China Southern Glass issues first B-share convertible bonds abroad (Switzerland).

July: A unit of the modern China Merchants Group gets the first overseas secondary listing by a Chinese company (Singapore).

1997

June: The SZSE shuts down its physical trading floor and adopts full electronic trading.

2000

March: Angang New Steel Co., Ltd. becomes the first listed company to issue convertible bonds.

2002

October: The SZSE becomes a member of the World Federation of Exchanges (WFE).

2004

May-June: Launch of the SME Board (Small-Medium sized Enterprises), with 8 companies making the debut.

December: The Southern Active Allocation Fund, China’s first listed open-ended mutual fund, is listed on the exchange.

2005

April: The Shanghai and Shenzhen 300 Index (CSI 300 Index) is officially launched.

September: Formation of China Securities Index Co., Ltd. – a 50-50 joint venture between the SSE and SZSE.

2006

September: The first ETF (exchange-traded fund) is listed.

2009

October: The ChiNext board is launched, with 28 original constituents. The board is modeled off of the Nasdaq Board in The US for tech-focused companies.

2010

December: The SZSE reaches 321 IPOs, ranking first among stock exchanges in the world for the year.

2014

October: The SZSE launches a first group of exchange-traded money market funds.

2016

December: The Shenzhen-Hong Kong Stock Connect scheme is launched, allowing investors from mainland China and Hong Kong to trade securities on each other’s exchanges.

2017

January: A group including the SZSE, SSE, CFFEX, Pak China Investment Company Limited, and Habib Bank Limited purchase a 40% stake in the Pakistan Stock Exchange.

2018

May: A-shares from the SZSE and SSE are added to the MSCI index.

2020

October: Shenzhen-Hong Kong ETF Connect is launched.

The Modern SZSE, By the Numbers

Top Line Stats

As of early 2024, the SZSE listed 17,651 unique securities on the exchange, including 2,883 companies (stocks), 664 funds, and 13,451 bonds.

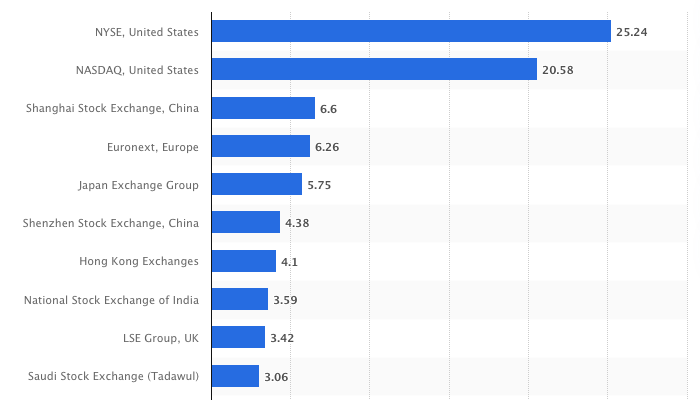

As of December 2023, The market capitalization of the Shenzhen Stock Exchange stands at $4.38 trillion USD, making it the world’s 6th largest stock exchange.

It’s important to emphasize that the Shenzhen Stock Exchange has grown to be the 6th largest global exchange by market cap in only 33 years!

To put that into perspective, here are the starting years of some of the other leading stock exchanges:

- Amsterdam Stock Exchange (now Euronext Amsterdam) – 1602

- Paris Stock Exchange (now Euronext Paris) – 1724

- New York Stock Exchange – 1792

- London Stock Exchange – 1801

- Bombay Stock Exchange – 1875

So the SZSE has been growing fast, and in tandem with China’s general economy and business wealth over the same period.

Check out our entry on the Beijing Stock Exchange

SZSE Indexes & Performance

SZSE Component Index

The SZSE Component Index contains the top 500 securities in the SZSE by market cap and thus is a good reflection of the bourse’s overall market performance. The index was launched on January 23rd, 1995, with a base value of 1,000 and a base date of July 20th, 1994. The value is up to over 8,800 as of writing this article in February 2024.

As with other main Chinese indexes, the SZSE component Index has grown steadily since its inception, and has hit some big peaks in 2007, 2015, and 2021.

In the 29 years spanning July 1994 to July 2023, the index returned about 41.6% per year – pretty darn excellent!

It’s important to note that a huge chunk of these returns came from the three run-ups mentioned above in 2007, 2015, and 2021. The volume of trades has also increased significantly since the mid-2010s – as evidenced by the red and green trading volume lines in the graph above.

These big swings have made timing the Shenzhen market difficult for most individual investors (ding ding to our Dollar-Cost Averaging article).

Another note that this is being written in February 2024, after quite a prolonged struggle (especially in 2022 & 2023) for the Chinese economy & markets.

For comparison, the S&P 500 returned an average of 7.58% from 1971-2022.

SZSE Composite Index

The SZSE Composite Index contains all of the stocks traded on The Shenzhen Exchange. As of early 2024, the number of stocks listed on the exchange is nearly 3,000.

SZSE 50 & 100 Indexes

These indexes are similar to the SZSE Component Index listed above, but only contain the top 50 and 100 companies by market cap, respectively.

ChiNext Index

The ChiNext Index kicked off in 2009 and focuses on providing a public board for tech businesses, similar to the NASDAQ in the US.

As of early 2024, there are 1,337 companies listed on the ChiNext.

And much like its NASDAQ cousin across the pond, the tech-focused ChiNext has been outperforming markets in general – that is until the recent Chinese economic struggles in 2022 & 2023. Even after this long slog down the last couple of years, the ChiNext is still averaging around a 7.7% return per year.

The Companies

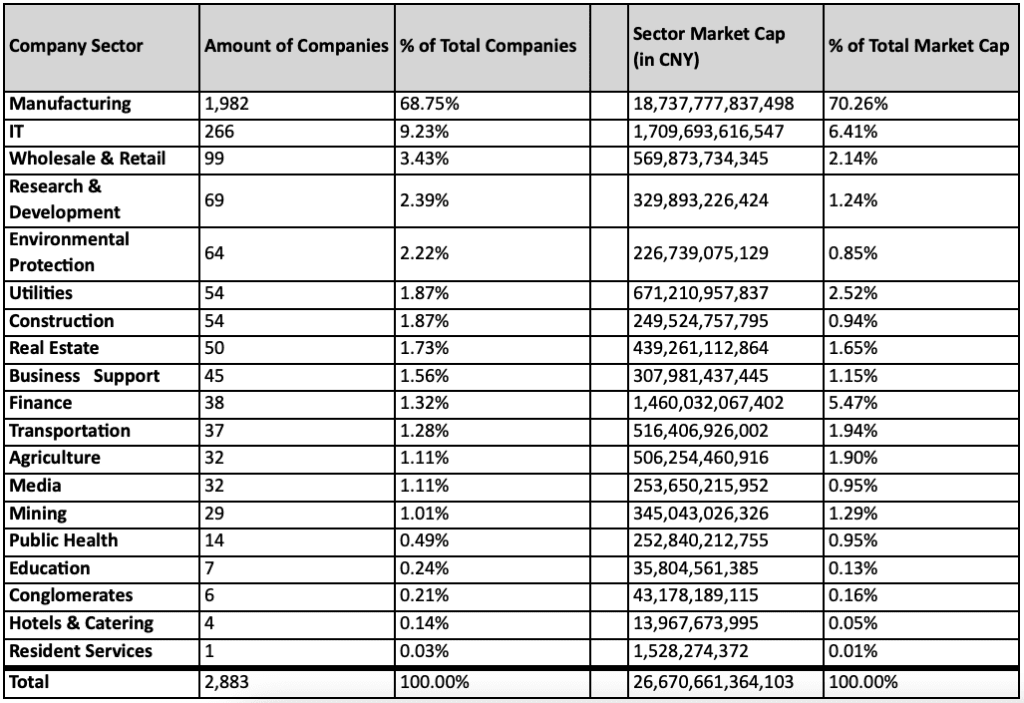

Industries Represented

The Shenzhen Stock Market hosts a diverse array of companies representing various sectors of the Chinese economy. These companies range from established giants to emerging startups, offering investors a broad spectrum of investment opportunities.

Here are a few of the main categories of companies on the exchange:s:

Technology and Innovation: The exchange is renowned for its vibrant technology sector, with numerous tech firms listed on its boards. The ChiNext board, in particular, was primarily created to focus on listing tech companies on the SZSE. These companies operate in cutting-edge fields such as artificial intelligence, biotechnology, e-commerce, and telecommunications, driving innovation and contributing to China’s technological advancement.

Manufacturing and Industrials: Traditional industries such as manufacturing and industrials also feature prominently on the Shenzhen Stock Exchange. These companies encompass a wide range of sectors, including automotive, machinery, aerospace, and construction, reflecting China’s status as a global manufacturing powerhouse.

Consumer Goods and Services: With the rise of the Chinese middle class and changing consumer preferences, companies in the consumer goods and services sector have witnessed significant growth. From retail and consumer electronics to hospitality and entertainment, these companies cater to the diverse needs and tastes of Chinese consumers.

Finance and Fintech: As China’s financial sector undergoes rapid transformation and digitalization, the Shenzhen Stock Market has become home to a burgeoning cohort of financial institutions and fintech firms. These companies play a crucial role in shaping the future of finance in China and beyond, leveraging technology to drive innovation in banking, payments, and investment services.

Healthcare and Biotechnology: With an aging population and increasing healthcare expenditures, the healthcare and biotechnology sector has emerged as a key area of focus for investors. Companies in this sector specialize in pharmaceuticals, medical devices, diagnostics, and healthcare services, addressing the evolving healthcare needs of China’s population.

Here’s a breakdown of the industries represented by A) % of total companies, and B) % of total market cap. The big note here is that manufacturing represents over two-thirds of the market. Maybe not so shocking as we are talking about a market in China – the world’s supplier! IT firms coming in at #2 is certainly the impact of the tech-focused ChiNext board.

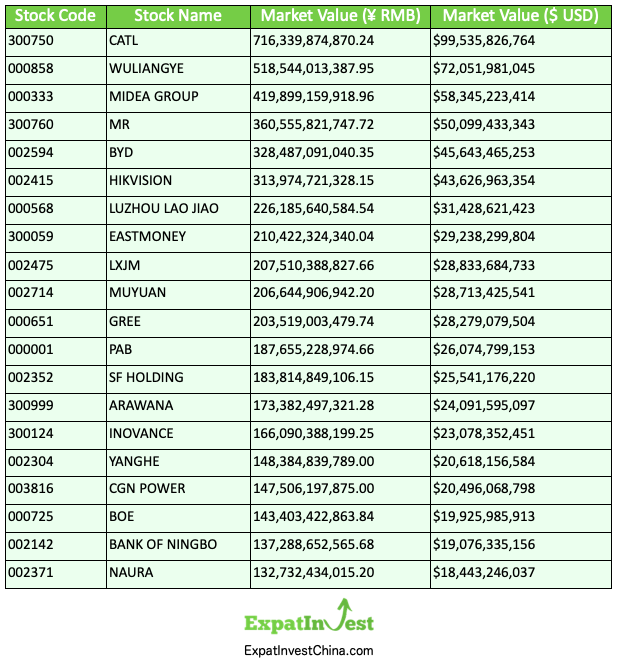

Top Companies/Stocks on the SZSE Exchange

Here are the top 20 companies traded on the exchange by market cap, as of SZSE’s data in Feb 2024:

Let’s Dive into these Companies (stocks) a bit!

1. Contemporary Amperex Technology Co., Ltd. (CATL)

CATL is a leading global manufacturer of lithium-ion batteries for electric vehicles (EVs) and energy storage systems. The company’s innovative battery technologies power a wide range of electric vehicles, from passenger cars to buses and trucks, and are also used in renewable energy storage applications. For more on this energy GIANT, check out our article covering CATL!

2. Wuliangye Yibin Co., Ltd. (WULIANGYE)

Wuliangye is a renowned Chinese distillery specializing in the production of baijiu, a traditional Chinese liquor. The company’s flagship product, Wuliangye, is celebrated for its rich aroma, smooth taste, and cultural significance. With a history spanning centuries, Wuliangye has earned a reputation as one of China’s most iconic and prestigious liquor brands.

It is the main competitor to the famous Baijiu brand and highest-valued company on the Shanghai Stock Exchange, Kweichow Maotai. We covered that liquor royalty here: Company Profile – Kweichow Moutai.

3. Midea Group Co., Ltd.

Midea Group is a leading Chinese manufacturer of home appliances, robotics, and automation systems. The company’s diverse product portfolio includes air conditioners, refrigerators, washing machines, kitchen appliances, and industrial robots. Once again! We did a dive into this consumer conglomerate here: Company Profile – Midea Group.

4. Meituan (MR)

Meituan is a leading Chinese technology platform offering a wide range of services, including food delivery, hotel reservations, travel bookings, and online retail. The company’s flagship service, Meituan-Dianping, is China’s largest online platform for local services, connecting consumers with merchants across various sectors. It is essentially an Everything App rolling up services you’d find on Uber, Kayak, Yelp, Groupon, and Amazon all into one!

Meituan is a great example of a tech-first company on the ChiNext Exchange – it is in the top 5 of the entire SZSE and was only founded in 2010 and public in 2018.

5. BYD Company Limited (BYD)

BYD is a leading Chinese manufacturer of electric vehicles (EVs), rechargeable batteries, and renewable energy solutions. The company’s EV division produces a wide range of electric cars, buses, and trucks, catering to both consumer and commercial markets.

We’ll be back with more additions to this top-20 list with the next update. The Shenzhen Exchange is a vast topic, rendering this an ongoing project..!

Wrap Up

We hope you’ve learned a thing or two about one of China’s big three stock exchanges! This writer certainly did while researching.

As mentioned, we have covered China’s other two big exchanges in a similar fashion:

The Shanghai Stock Exchange: An Introduction

The Beijing Stock Exchange: An Introduction

And looked into some of the companies on the Beijing Exchange here:

The Beijing Stock Exchange: BSE 50 Mini-Profiles

Ganbei!

More sources & further reading:

http://www.szse.cn/ - https://www.tradinghours.com/markets/szse

- https://www.statista.com/statistics/270126/largest-stock-exchange-operators-by-market-capitalization-of-listed-companies/

- https://www.china-briefing.com/news/what-can-the-newly-approved-etf-connect-between-mainland-china-and-hong-kong-bring-to-foreign-investors/

- https://www.hkex.com.hk

- SZSE building architects: https://www.oma.com/ , https://en.wikipedia.org/wiki/Office_for_Metropolitan_Architecture

Share this article: