As an expatriate, understanding the nuances of the cost of living in China is crucial for financial planning, especially when considering retirement. China’s unique landscape presents diverse living costs across Tier 1 cities like Shanghai, Shenzhen, and Beijing, and smaller cities. Utilizing the Cost of Living Index we can gauge these expenses in comparison to your home country gaining insight into the income relative to local living costs. However, New York is often used as the central point of comparison, which will be the case in this blog.

Cost of Living in China: City Breakdown

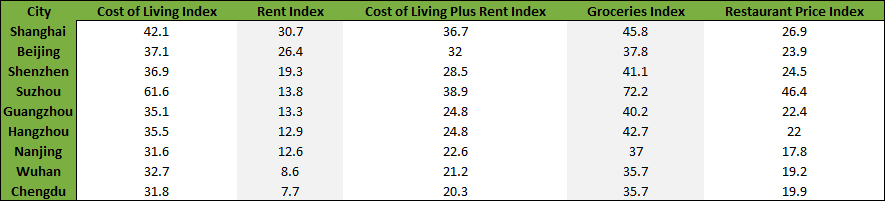

Looking at the table below we can note that the rent index is the highest in Shanghai (42.1), Beijing (37.1) and Shenzhen (36.9) which means housing in these cities is more expensive and likely to be a higher section of your monthly budget. When compared to New York, these Chinese cities’ living expenses showcase unique financial landscapes, where income relative to local costs becomes a crucial factor.

Categories

Cost of Living Index (Excl. Rent): This metric reflects the comparative costs of consumer goods like groceries, dining, transportation, and utilities while excluding expenses related to accommodation, such as rent or mortgage. For example, Nanjing with a Cost of Living Index of 31.6 would be 68.4% lower than New York City (excluding rent).

Rent Index: This metric gauges the costs of leasing apartments in a city in comparison to New York City. Shanghai Rent Index stands at 61.6, which implies that the average rental prices in that city are roughly 38.4% lower than those in New York City.

Cost of Living Plus Rent Index: This gauge evaluates consumer goods prices, inclusive of rent, relative to New York City. This provides useful context. Chengdu’s Cost of Living Index is 31.8 but has a Rent Index of 7.7 resulting in a Cost of Living Plus Rent Index of 20.3, 79.7% Cheaper than New York City.

Groceries Index: This measure offers an assessment of grocery costs in a city compared to New York City. In our table Wuhan is at 35.7 is estimated to be 64.3% cheaper than New York City.

A word of warning

A word of warning for our China Expats out there, as with every piece of information we must consider whether its source is valid. For example, as someone living in Suzhou, I find the high Groceries Index of 72.2 quite suspicious! Additionally, you must consider your lifestyle, if you are going to eat lots of Bok Choy (cooked well it’s delicious!) you will likely be closer to the Groceries Index than if you buy Maple Syrup or other foreign delicacies.

Balancing Income and Local Costs

As an Expatriate you must recognize that your salaries in China may be lower compared to your home country, thankfully the lower local costs can often balance this disparity. This emphasizes the importance of purchasing power as a defining factor for your quality of life as an expat in China. Understanding how your income translates to expenses is vital for ensuring financial stability and a comfortable lifestyle. There is an additional caveat, you may have additional costs that local do not have, such as expensive travelling to see your family once in a while, or a good international health insurance.

The Long-Term View: Planning for Retirement

Here comes the hard truth, unless you have a class A Work Permit or your Permanent Residence, you are expected to leave when you reach 60 years old. When contemplating retirement, it’s essential to factor in the cost of living, particularly if you consider a return to your home country. Even with a comfortable income in China, expatriates should remain mindful of the need for prudent financial planning, to ensure a secure retirement. Even if you live a good life in China, the amount of money you save for retirement should be according to your expenses where you will be retiring. Savvy financial decisions now can significantly impact the quality of life in the future, especially when transitioning from a potentially lower-cost environment to one with higher living expenses.

By looking beyond the present and considering the long-term financial implications, expats in China can proactively strategize for a secure retirement. While enjoying the cultural and professional opportunities China offers, it’s crucial to cultivate a financial plan that accommodates not only the current lifestyle but also the potential transition back to a higher cost of living environment in the future.

Conclusion

China, as a vibrant and diverse expat destination, presents unique considerations for cost of living and financial planning. Understanding the income relative to local living costs, and how it affects purchasing power, is fundamental for financial stability. For expatriates eyeing retirement, recognizing the potential shift in cost of living dynamics between China and their home country is equally critical, necessitating prudent financial choices. By navigating these factors thoughtfully, expats can not only embrace China’s current opportunities but also build a secure financial future, ensuring a comfortable retirement wherever they choose to settle.