Investing and saving are essential components of financial health, and there is no better strategy to maximize your investments than understanding and harnessing the power of compound interest. As an expat in China, grasping this concept can significantly enhance your financial success and help you achieve your long-term financial goals.

Understanding Compound Interest

Let’s start with the basics: what exactly is compound interest? Simply put, compound interest is the interest on a loan or deposit calculated based on both the initial amount and the accumulated interest from previous periods. Unlike simple interest, which is calculated only on the principal amount, compound interest yields more substantial returns over time.

To go into the nitty gritty, here is the formula for compound interest:

A = P (1 + r/n)^(nt)

Where:

• A = the future value of the investment, including interest

• P = the principal investment amount

• r = the annual interest rate (decimal)

• n = the number of times interest is compounded per year

• t = the number of years the money is invested or borrowed for

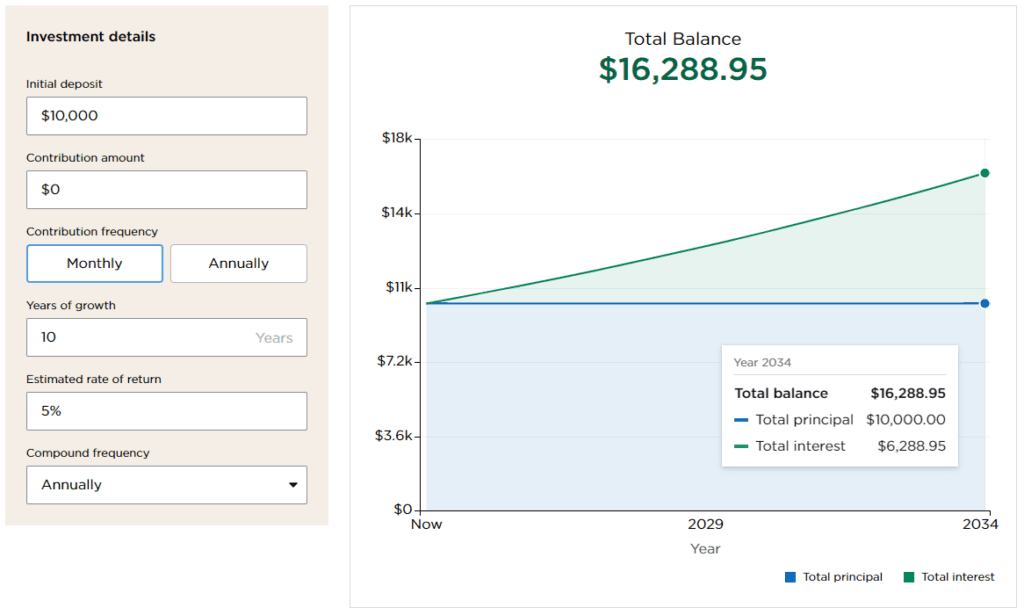

It can look scary, so let’s use an example! if you invest RMB 10,000 at an annual interest rate of 5%, compounded annually for 10 years, using the compound interest formula, you’d end up with RMB 16,288.95. Those RMB 6,288.95 in interest showcase the magic of compounding over time. There are many calculators online, below is an example from Nerd Wallet.

The Power of Compound Interest Over Time

Time and Growth

You probably already noted that time is your most precious ally when it comes to compound interest! One of the most remarkable aspects of compound interest is its exponential growth over time. This means that the longer you keep your investment untouched, the more significant your returns become. Visual aids, like graphs or charts, can beautifully illustrate how an initial investment grows dramatically with compound interest compared to simple interest.

The Rule of 72

A quick and handy way to estimate how long it will take for an investment to double at a fixed annual rate of interest is the Rule of 72. By dividing 72 by the annual interest rate, you get an approximate period for your investment to double. For example, at a 6% interest rate, it would take approximately 12 years (72/6=12) for your investment to double.

Practical Applications of Compound Interest for Expats in China

For expats in China, local investment seems burdened by bureaucracy if not completely impossible. This is why ExpatInvest exist, the goal of our platform is to make investment in RMB in the local market convenient for Expats in China!

How to Calculate When the Annual Interest Rate Is Not Fixed?

Previously, we discussed the fixed interest rate. How should you approach this calculation? A viable option is to utilize the annual average as indicated on the fund page. Notably, high-risk investments like the China Modern Manufacturing Industry are subject to significant fluctuations. Hence, it is advisable to adopt a conservative approach and estimate a lower annual return in your calculations. Stable options such as the Conservative Bond & Stock Blend permit a closer estimation of the average. When evaluating investments or planning your budget, it is prudent to err on the side of caution and employ conservative calculations.

Strategies to Maximize Compound Interest for Expats

Start Early

One of the most straightforward yet effective strategies to maximize compound interest is to start investing as early as possible. The sooner you begin, the longer your money has to grow exponentially.

Regular Contributions

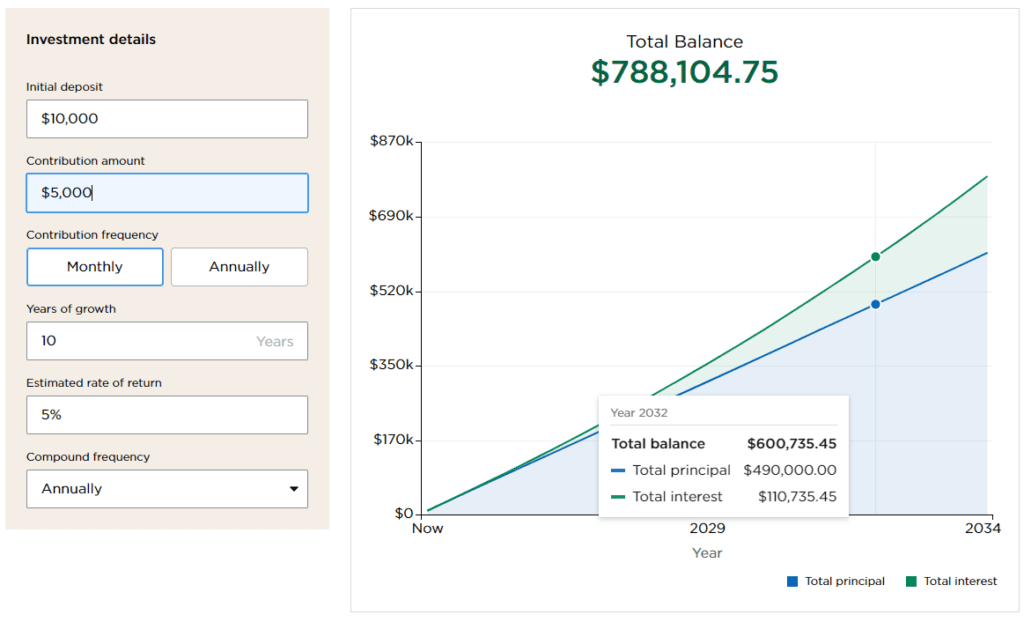

Consistent, regular contributions to your savings and investment accounts can significantly boost the benefits of compound interest. Automated contributions ensure discipline and steady growth of your principal amount. Below is the same example from Nerd Wallet, but this time there are monthly contributions of 5000. You can easily see a stark difference in total interest from around 6000 to around 110,000!

Pitfalls and Misconceptions Around Compound Interest

Inflation

While compound interest significantly increases your wealth, inflation can erode the real value of those returns. It’s essential to consider inflation-adjusted returns when planning your investments. China is currently at 0.2% and the USA at 4.1%.

Fees and Taxes

Fees and taxes can significantly impact your compounded growth. As an expat in China, it’s crucial to choose investment vehicles with low fees and understand the tax implications to minimize these costs.

Market Volatility

Investing in volatile markets can impact compound returns. A diversified and balanced portfolio can help mitigate the risks associated with market fluctuations and ensure steady compounding growth. Importantly, your portfolio should fit your risk profile.

Playing the Market

Playing the market, or engaging in short-term trading, is extremely difficult and typically not recommended for most investors, this has been studied for over 20 years and even experts have difficulty consistently beating the market. Market timing requires accurate predictions of when to buy and sell assets, which is incredibly challenging. Moreover, frequent trading often leads to higher transaction costs and taxes, potentially eroding overall returns. On the other hand, long-term investing tends to offer more sustainable growth potential, aligning with a broader economic expansion and allowing for the weathering of short-term market fluctuations.

Emotion and panic selling

During periods of market volatility or underperformance, it’s common for emotions to play a significant role in investment decisions. Many investors may experience panic selling, driven by fear and anxiety about potential losses. However, it’s essential to recognize that while markets can be unpredictable in the short term, the long-term trend has historically been upward. Succumbing to emotional impulses and making hasty decisions during downturns can lead to missing out on potential recovery and growth. Maintaining a long-term perspective, grounded in understanding historical market trends, can help investors withstand market fluctuations and stay focused on their long-term financial goals.

Conclusion

Understanding and leveraging compound interest is essential for expats in China looking to build wealth and secure their financial future. By starting early, making regular contributions and reinvesting earnings, you can harness the power of compound interest to achieve your financial goals.

For more insights, check out our other articles on ExpatInvest China.