For many, the thought of starting to invest can be daunting.

Can I start without any experience?

Is creating an account simple?

Am I really ready now?

Is it worth investing with only 1000 RMB?

The answer is YES! Regardless of how you start, start early. Learning through action gives you confidence and experience so you can manage your wealth as it grows while taking losses in stride. Purchasing mutual funds is an excellent way to gain experience as an investor, so start your portfolio today!

Below are some common questions from new investors.

How can I start investing as an Expat in China?

Let’s take a peek at what you need to get started with ExpatInvest:

- A valid foreign passport

- A valid work permit for China

RMB 1,000,000+

No, you don’t need millions to start investing! Many people start with only 1000RMB. However, you meet the requirements to buy and sell mutual funds as foreign worker in China. Simply create an account on the website, upload your documents, and you are ready to begin!

:max_bytes(150000):strip_icc():format(webp)/mutualfund-final-253e20b35df7479b8afb203b56c934c2.png)

What is a mutual fund?

Basically, mutual funds are baskets of stocks from different companies which have a theme: similar size, similar industry, similar geography, etc. With individual stocks, prices can rise and fall rapidly. But, the price of a mutuals are more stable and is less influenced by the individual companies. Investors like the stability of mutual funds and this diversification makes mutual funds popular amongst investors. There are also different types of fund: bonds, stock and hybrid funds. Read our detailed post on this exact topic!

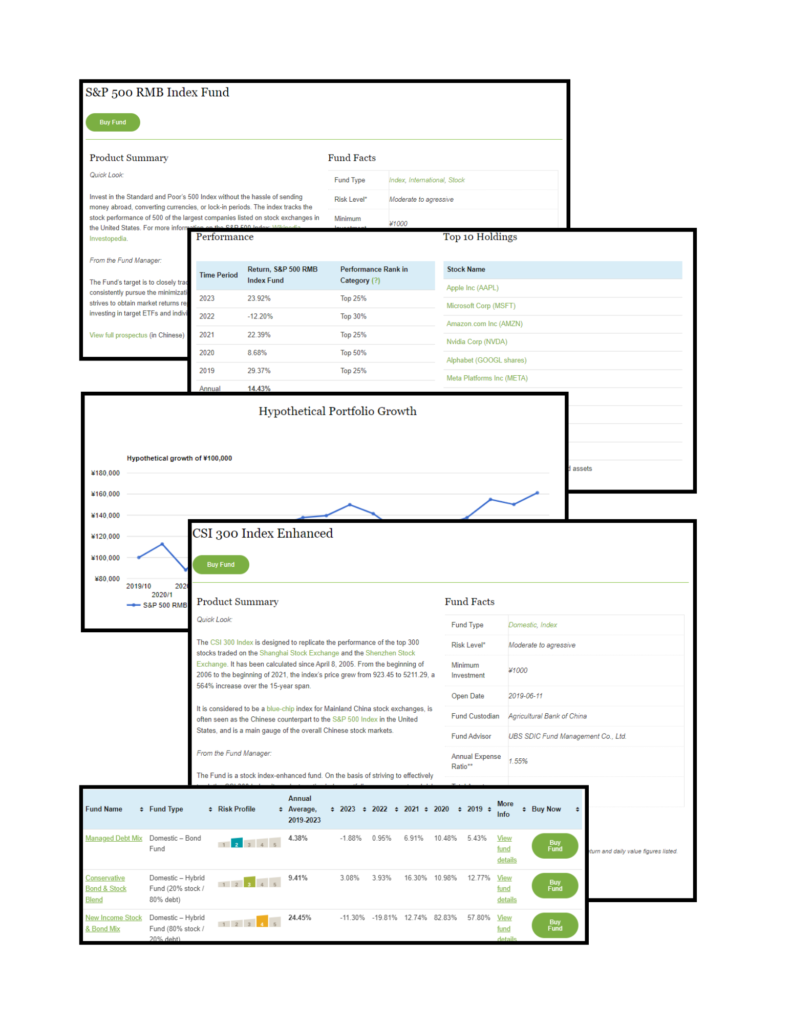

How do I read a mutual fund page?

Don’t get lost when researching a fund. Focus on a few details to evaluate the fund you’re considering.

- Top 10 Holdings: This is the best place to start to understand the investment focus of a fund! Do you want to own name-brand stocks like Apple, Alphabet, and Tesla? Then the S&P 500 may be for you. Are you betting on Chinese blue chips like Moutai, Midea, and China Merchants Bank? Then the CSI 300 is a great starting ground. Are you convinced that the Chinese battery supply chain will take over the world? So get started with the China Modern Manufacturing Industry fund! Take a close look at the Top 10 holdings and do your own research to get started.

- Risk Level: each fund page contains a short explainer on risk levels, but the logic of risk scoring in China is simple: Bond-only funds are low risk. Stock-only funds are high risk. Choose the mix of risk levels that matches your comfort level.

- Annual Expense Ratio: this is important – these are the fees which the fund manager charges to run the fund. Remember, the lower this number, the better.

- Recent Performance: Historical performance of funds (and of fund managers) is not a predictor of future value. While this information is helpful, it should not be the only reason you purchase a fund. Performance should always be compared to a standard index, like the NASDAQ. Always compare!

- Net Asset Value (NAV): The NAV is the value of each share against the total assets in the fund at the end of the trading day. This is closely tied to the fund share price and is updated once per day.

Time to get started!

You’ve been thinking about your investment options. Now that you’ve taken a look, you’re ready to take the plunge. Remember, everybody starts somewhere. So think of your financial goals, like taking a vacation or buying a house. As an expat working in China, now you are ready to start saving for this future!