Gold ETF

Product Summary

Quick Look:

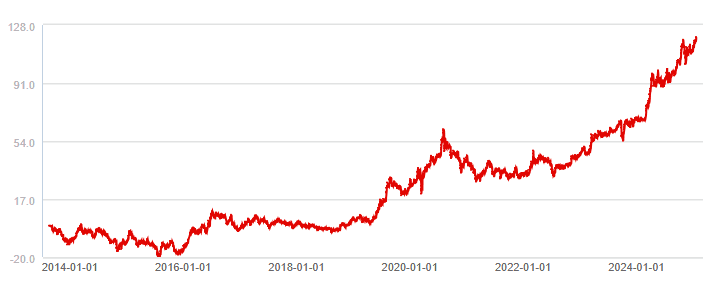

The Gold EFT is designed to follow the spot rate of gold commodities. It has been traded on the Shanghai Stock Exchange August 22, 2013. From 2013 to the beginning of 2025, the fund price grew 118%, compared to the growth of the Shanghai Index of 62% over the same period.

From the Fund Manager:

The Fund mainly invests in target ETF fund shares and gold products such as gold spot contracts traded on the Shanghai Gold Exchange. Under normal circumstances, the proportion of the Fund’s investment in the target ETF shall not be less than 90% of the Fund’s net asset value, and cash or government bonds with a maturity date of less than one year shall not be less than 5% of the Fund’s net asset value.

View full prospectus (in Chinese)

Fund Facts

** Expense ratio amounts are already included in the return and daily value figures listed. More info on fees.

Performance

Scroll to view more info >>

(this price is updated every business day)

Top 10 Holdings

| Stock Name | Stock name (Chinese) | Portion of net worth |

|---|---|---|

| Gold ETF | 黄金EFT | Above 90% |

Hypothetical Portfolio Growth

Historical Performance

This chart illustrates the fund performance in since 2020.