The modern version of the Shanghai Stock Exchange (SSE) was established in November 1990, making it only 32 years old. In that time it has grown rapidly to become the third-largest exchange by market cap in the world!

Let’s go through some historic milestones and then dive into the SSE’s modern era and figures.

History

First Era: 1866-1941

Mid-1800s: Shanghai had emerged as a global trading hub.

1866: The first share list was put on paper.

1891: The ‘Shanghai Share Brokers Association’, an early form of a stock exchange, was established in Shanghai.

1904: The Association was renamed to “Shanghai Stock Exchange” and the supply of securities came primarily from local companies.

1920-21: “Shanghai Securities & Commodities Exchange” and “Shanghai Chinese Merchant Exchange” started operations.

1929: Local markets combined and operated thereafter as the “Shanghai Stock Exchange.”

1941: The operation of the Shanghai Stock Exchange came to an abrupt halt due to WWII.

Second Opening Post-WWII: 1946-1949

1946: The Shanghai Stock Exchange resumed its operations before closing again 3 years later in 1949. The index then shut down for a whopping 41 years until…

Modern Reopening, Stabilization, & Success: 1990-present

November 1990: The Shanghai Stock Exchange was re-established and operations began a few weeks later in December.

2019: The Shanghai Stock Exchange launched the STAR Market, featuring only technology-related companies, as a comparable to the NASDAQ.

The Modern SSE, By the Numbers

As mentioned above, the Shanghai Stock Exchange has grown to be the 3rd largest global exchange by market cap, only smaller than the New York Stock Exchange (NYSE) & NASDAQ. Not bad for an exchange that is essentially 32 years old!

Amsterdam Stock Exchange (now Euronext Amsterdam) – 1602 Paris Stock Exchange (now Euronext Paris) – 1724 New York Stock Exchange – 1792 London Stock Exchange – 1801 Bombay Stock Exchange – 1875

Check out our entry on the 1-year-old Beijing Stock Exchange

The SSE Composite Index

The SSE Composite (also known as Shanghai Composite) Index is the most commonly used indicator to reflect SSE’s market performance. The index was launched on July 15, 1991, with a base value of 100, and is up to over 3,100 as of writing this article in January 2023.

That translates to about a 9.836% increase per year in the index’s history. Pretty good! And note that this is being written in January 2023, after a prolonged struggle for the Chinese economy & markets. If we were to remove 2022 from the equation (a negative 15% year for the SSE), the average would be closer to 12%.

For comparison, the S&P 500 returned an average of 7.58% from 1971-2022.

SSE Stock Components

At the end of 2021, 2,037 companies with a total of 2,079 stocks were listed on the Shanghai Stock Exchange, an increase from only 870 listed companies in 2009.

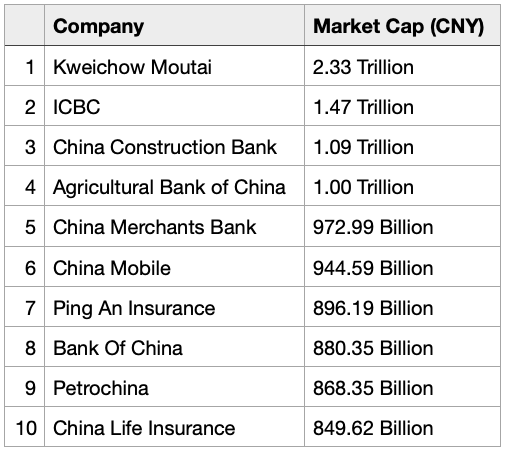

Here are the top 10 companies traded on the exchange by market cap:

You’ll notice that the top dogs here are mostly state-owned or state-backed finance, insurance, telecom, and energy companies, no big surprises here… except for the #1 slot going to beloved Baijiu maker Kweichow Maotai.

As of 2021, Kweichou is the largest beverage company in the world and China’s most valuable company, recently overtaking Tencent as China’s largest company by market capitalization. People sure do love and trust this baijiu conglomerate in China!

Wrap Up

We hope you’ve learned a thing or two about China’s largest stock exchange, we sure did in researching for this piece. I’m going to leave it here for now, but please reach out if you have any other China finance topics you’d like to read about for our future pieces. Ganbei!

Sources & further reading:

https://simplywall.st/stocks/cn/market-cap-large https://www.forbes.com/advisor/investing/average-stock-market-return/ https://www.oldest.org/technology/stock-exchanges/ https://www.google.com/finance/quote/000001:SHA?window=MAX https://finance.yahoo.com/quote/000001.SS/history https://en.wikipedia.org/wiki/Shanghai_Stock_Exchange http://english.sse.com.cn/aboutsse/overview/ https://tradingeconomics.com/china/stock-market https://www.tradingview.com/markets/stocks-china/market-movers-large-cap/ https://www.statista.com/statistics/982363/china-number-of-listed-companies-at-shanghai-stock-exchange/

Share this article: