The CSI 300 is arguably the most well-known and widely used stock market index in the Chinese markets.

It tracks the top 300 stocks in the Shanghai and Shenzhen stock markets. These 300 stocks are weighed according to the total market value of their outstanding shares on the market.

For example: Ping An Bank, the behemoth finance & insurance company, has a market cap of nearly ¥250 billion CNY as of 8/2022. ZTE, the telecommunications giant, has a market cap of about ¥100 billion CNY. Ping An Bank is going to have roughly 2.5 times more weight in the CSI 300 index than ZTE.

The Name

The index’s Chinese name is 沪深300, which incorporates the characters “沪 Hù” (a historical reference to Shanghai), and “深 shēn” (the ‘shēn’ in Shenzhen). The index tracks a portfolio of the top 300 companies in the combined Shanghai and Shenzhen stock markets – which makes the Chinese name seem quite obvious – the ‘Shanghai & Shenzhen 300’!

The CSI acronym that the English speaking world is familiar with comes from the firm that provides this index – the China Securities Index Company. This is in line with how many other global indexes are named:

- S&P 500 (Standard & Poor’s)

- Dow Jones Industrial Average (originally by Dow Jones & Company)

- Russell 2000 (originally by the Frank Russell company)

- FTSE 100 (Financial Times Stock Exchange Group)

The Companies

So! We’ve got a collection, or ‘basket’, of the 300 biggest public companies on the combined Shanghai and Shenzhen stock markets. What kind of stocks and companies are in there?

Because the CSI 300 is, by design, the 300 largest companies by market cap, the index is made up almost entirely of blue chip stocks. Blue chips are basically huge companies, usually with a relatively long history and solid reputation.

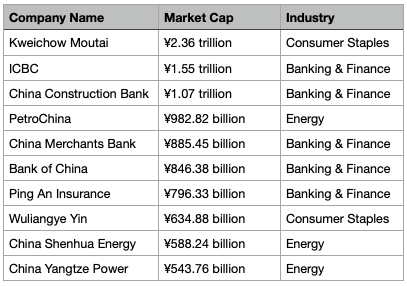

Let’s take a look at some of the biggest companies on this list today!

Here is a quick snapshot of the top 10, as of 9/2022. The undisputed champ at the top is beloved baijiu brand Kweichow Maotai with market cap of 2.36 Trillion CNY. Wow! The more you read about the Chinese markets, the more you’ll see how much Chinese investors love this brand. From there we see a list of renowned Chinese banks and Energy companies rounding out the top 10.

Here’s the full list of CSI 300 component companies in case you want to dive in a bit more.

The History

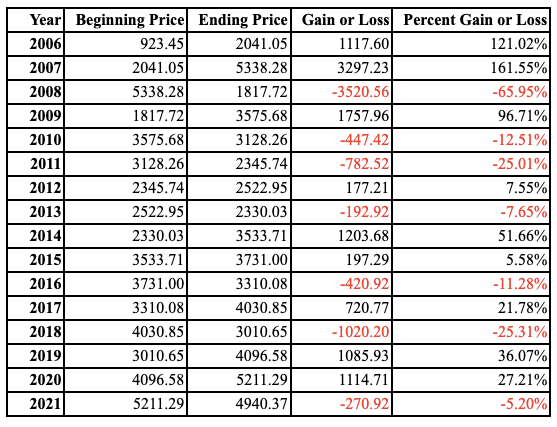

The CSI 300 first started being calculated at the beginning of 2005, with the first value being 1,000 on December 31st, 2004.

As of writing this article, the index is priced just over 4,000 – which equates to a 4x increase in just shy of 18 years. The index has trended up over time, with a few distinct peaks in 2008, 2015, and 2021.

If we take the annual returns data, we get an average increase of 22.51% per year between 2006-2021. Not bad at all!

For comparison, the S&P 500 returned an annual average of 12.32% per year in the same time period.