China Modern Manufacturing Industry

Product Summary

Quick Look:

Modern manufacturing, machinery, transportation, and mining. Invest in the companies fueling China’s high-performing engine of growth.

From the Fund Manager:

The fund will focus on investing in industries where market demand is stable or maintains a relatively high growth rate. According to the characteristics of the current industry cycle, the fund will belong to the transportation, construction products, electrical equipment, machinery manufacturing, aerospace and defense, environmental protection equipment, business services and supplies, construction engineering, and other industries in accordance with the China Securities Industry Classification Description.

View full prospectus (in Chinese)

Fund Facts

** Expense ratio amounts are already included in the return and daily value figures listed. More info on fees.

Performance

Scroll to view more info >>

| Time Period | Return, China Modern Mfg Industry Fund | Performance Rank in Category (?) | Return, CSI 300 Index benchmark (?) |

|---|---|---|---|

| 2024 | -15.46% | Bottom 50% | 14.68% |

| 2023 | -21.55% | Bottom 50% | -11.38% |

| 2022 | -32.37% | Bottom 50% | -21.63% |

| 2021 | 22.93% | Top 20% | -5.20% |

| 2020 | 130.56% | Top 0.1% | 27.21% |

| 2019 | 54.74% | Top 30% | 36.07% |

| Annual Average | 23.14% | 6.63% | |

| Open Date | 2018/5/17 |

Returns Comparison

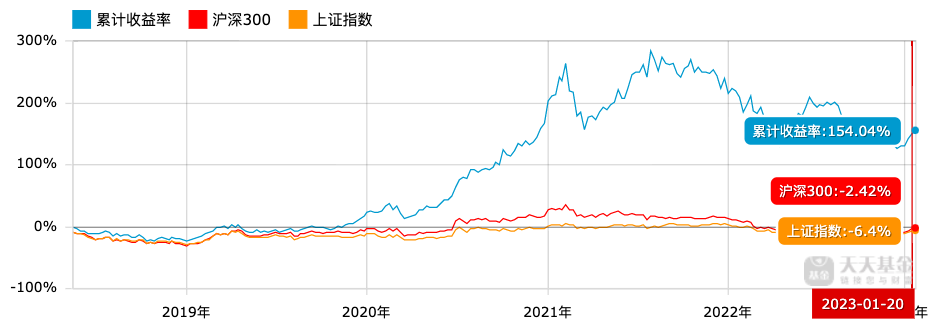

This chart illustrates the fund performance in comparison to the general Chinese markets from 2018/5/14-2023/1/20. The China Modern Manufacturing Industry fund is in blue, the CSI 300 Index in red, and the Shanghai & Shenzhen Composite in orange.

Over this timeframe, the China Modern Manufacturing Industry fund outperformed the CSI 300 Index by 156.46% and the Shanghai & Shenzhen Composite by 160.44%.

Top 10 Holdings

Hypothetical Portfolio Growth

Returns Comparison

This chart illustrates the fund performance in comparison to the general Chinese markets from 2018/5/14-2023/1/20). The China Modern Manufacturing Industry fund is in blue, the CSI 300 Index in red, and the Shanghai & Shenzhen Composite in orange.

Over this timeframe, the China Modern Manufacturing Industry fund outperformed the CSI 300 Index by 156.46% and the Shanghai & Shenzhen Composite by 160.44%.