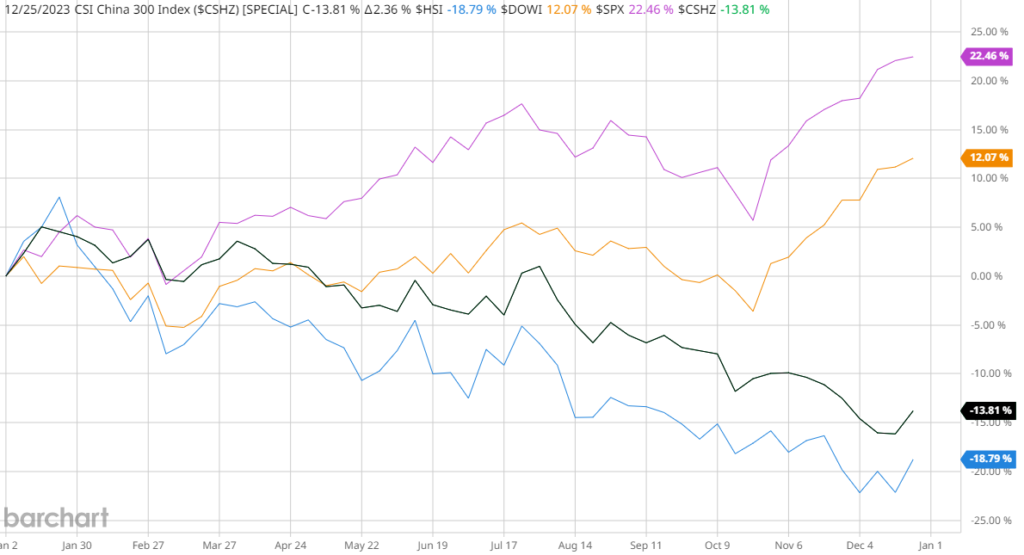

Contrasting performance

For the US and China, 2023 was a tale of two markets. While the eagle soared to new heights, the dragon dug deep into the mountainside. For investor active in both markets, it was a year of highs and lows. Understanding the context in both markets can help frame your investment strategies for 2024. Let’s dive into some of the macro trends, highlights and lowlights. [All numbers in brackets refer to the full year financial performance of the stock, fund, or index mentioned.]

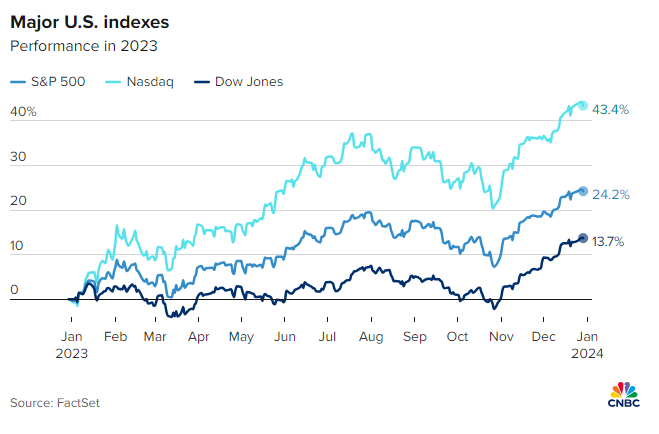

The US staves off a recession

In the US, the economy experienced strong bounce back from the pandemic. The S&P 500 (+24%), NASDAQ (+43.4%) and the Dow Jones Industrial Average (+14%) reached new highs.

Some large-cap companies seeing growth in the triple digits. With the raise of AI, companies like Nvidia (+239%) saw unprecedented demand for their technologies. Adjacent companies with a strong tie to AI companies, like Microsoft (+57%) who developed key partnerships with core-AI companies like OpenAI, also performed well. Much of the growth in the US indices was driven by a small group of very large companies, namely “The Magnificent Seven,” while the longer tail of other companies in the index averaged more modest single digit share price growth.

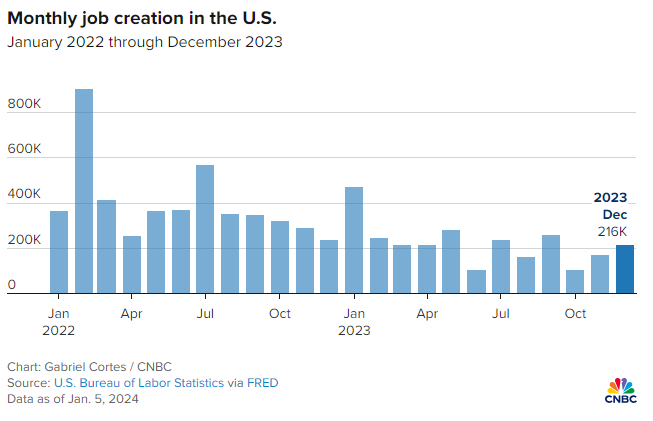

Job numbers were strong (+2.7m), unemployment remained relatively flat, and inflation growth began to wane. Central banks managed to balance tightened fiscal policy with strong economic growth. Housing sales declined, weakening GDP growth, due in part to very high mortgage rates which have refused to come down.

Early in 2024, the eagle shows now signs of landing.

For more overviews of the performance of the US markets, check out the 2023 reviews from JP Morgan, CNBC and Morningstar.

China struggles post-Covid

In China, the recovery from Covid has taken a slower pace. China downgraded COVID-19 to a Category B infectious disease on January 8th, taking initial steps to reopen much later than other developed nations. With this step, 2023 became a year of recovery against low economic performance in 2022. GDP growth in Q1-Q3 (+5.2%) outpaced expectations and China was once again one of the fastest growing develop nations. Domestic and international tourism and business travel resumed, albeit at reduced levels.

Real estate, crucial to China’s economy, performed weakly and saw significant double-digit reductions in fixed asset investment. Housing prices declined as uncertainties in the overall property market and China’s debt-laden property developers cast shadows on economic growth. Real estate is responsible for a significant percentage of China’s overall GDP, and decreased investment into new construction impacts both GDP and consumer confidence. Confidence is also impacted by the high youth unemployment rate, which remains in the double digits, significantly above the national average.

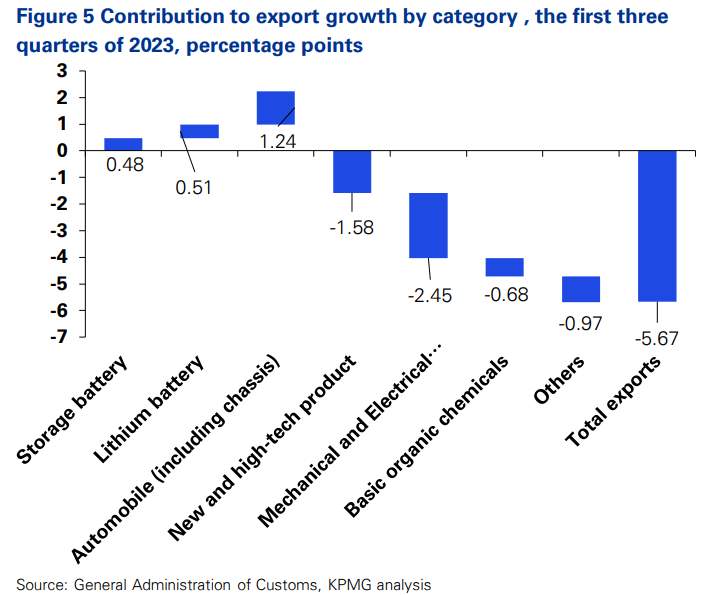

Exports are rebounding slowly, although above expectations. Overall exports are down (-5.67% Q1-Q3), with new energy and automotive bucking the trend. BYD overtook Tesla as the world’s largest producer of electric vehicles, and with a consolidated supply chain and many other Chinese companies in their ecosystem, this could drive new growth into 2024.

For more information on China’s economy in 2023, please visit China Briefing, KPMG, and Caixing (paywall).

2024 will bring its own uncertainties and opportunities. Concerns of overvaluation of US securities may reduce confidence and lead to a sell-off later in 2024. For China, with the fundamentals of the economy still strong, the loosening of restrictive policies may have an outsized effect. If so, we may see the bottoming out of China’s capital markets in 2024, and a return to a more moderate and robust economy and capital market performance.

Expats in China have mutual fund investment connected to markets both inside and outside of China. To learn more, contact us on WeChat today.